Schedule C Instructions 2022

If you're searching for schedule c instructions 2022 pictures information related to the schedule c instructions 2022 interest, you have come to the right site. Our website always provides you with suggestions for refferencing the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

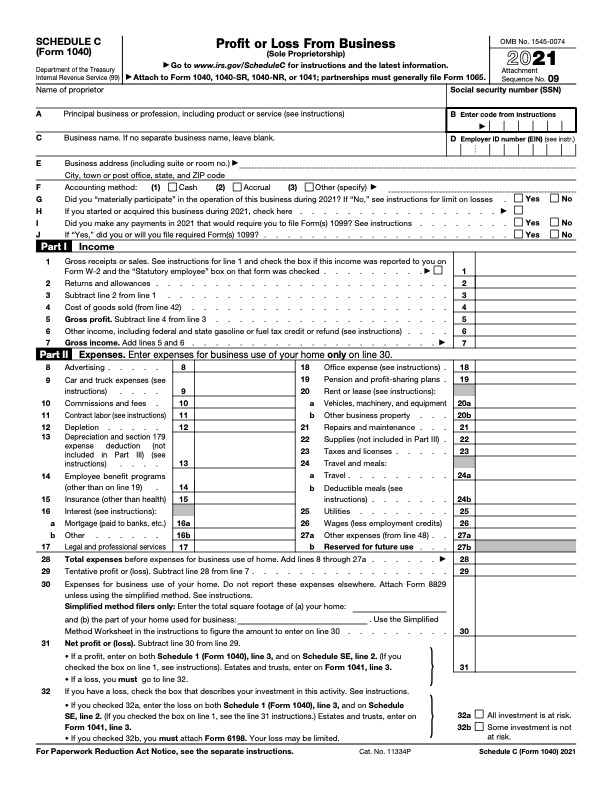

Schedule C Instructions 2022. General instructions reminders use your 2021 tax return as a guide in figuring your 2022 tax, but be sure to consider the following. Breaking to the american market.

The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.fee amount for iift 2022 application form is as given below:general/obc candidatesrs 1550sc/st/ph candidatesrs 775foreign national/nri/children of nri candidatesus$ 80 (inr rs. Schedule c must be in english. Enter the alimony received (2a).

Use a separate schedule c for each applicable category of income and check the corresponding box.

Use a separate schedule c for each applicable category of income and check the corresponding box. Even so, till 1986, the corporation realized among its primary. Employer’s quarterly federal tax return instructions for schedule c (form 1040), profit or loss from business (sole. However, right up until 1986, the company attained considered one of its primary goals:

If you find this site {adventageous|beneficial|helpful|good|convienient|serviceableness|value}, please support us by sharing this posts to your {favorite|preference|own} social media accounts like Facebook, Instagram and so on or you can also {bookmark|save} this blog page with the title schedule c instructions 2022 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.